rhode island property tax rates 2020

2021 Tax Rates. Start Your Homeowner Search Today.

Riverside County Ca Property Tax Calculator Smartasset

Rhode Island Tax Brackets for Tax Year.

. 3470 apartments 6 units. Service charges are tied to a percentage of any taxes reduced by your tax advisor. Selected applicants will be placed on the waiting list by date and time the application is received by order of preferences.

FY 2019 Property Tax Cap. Northeast Revaluation Group LLC 205 Hallene Road Unit 213 Warwick Rhode Island. 135 of home value.

Narragansett has a property tax rate of 886. 41 rows West Warwick taxes real property at four distinct rates. Includes All Towns including Providence Warwick and Westerly.

The countys average effective rate is 178. Jamestown has a property tax rate of 828. FY 2017 Property Tax Cap.

FY 2018 Property Tax Cap. 3 rows Rhode Islands 2022 income tax ranges from 375 to 599. Search Valuable Data On A Property.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. FY 2022 Rhode Island Tax Rates by Class of Property Assessment Date December 31 2020 Tax Roll Year 2021 Represents tax rate per thousand dollars of assessed value. FY 2020 Property Tax Cap.

2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily. Ad Get In-Depth Property Tax Data In Minutes. Newport has a property tax rate of 933.

FY 2021 Property Tax Cap. 2257 one family residence estates farms seasonalbeach property residential vacant land residential buildings on leased land. 2989 - two to.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over. The City of Revere provides two online tools anyone can use to look up property information. On average Kent County has the second-highest effective property tax rate in the state of Rhode Island.

Taxable Estate Base Taxes Paid. To figure out how much you owe in property taxes take your assessed value divide it by 1000 and then multiply it by your towns tax rate. Persons requiring assistance completing an application can call.

Such As Deeds Liens Property Tax More. RHODE ISLAND ESTATE TAX RATES. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax.

The median property tax in Rhode Island is 361800 per year based on a median home value of 26710000 and a median effective property tax rate of 135. Rhode Island Tax Brackets. 15 Tax Calculators.

In the absence of tax savings you dont pay at all. Rate Threshold 1 40000. RI or Rhode Island Income Tax Brackets by Tax Year.

1300 per thousand of the assessed property value. The countys largest city is Warwick which. After closing at 1601 for 2020 that rate climbed to 1642 the following year.

Protest firms are incentivized to fully pursue your billing. That represents one of the larger increases for any municipality in Rhode Island. The current tax rates and exemptions for real estate motor vehicle and tangible property.

2932 two to five family. A list of Income Tax Brackets and Rates By Which You Income is Calculated. Here are the property tax rates per 1000 of.

1300 per thousand of the assessed property value. 4 West Warwick - Real Property taxed at four different rates. Real and Personal Property in all other municipalities is assessed at 100.

Charlestown has a property tax rate of 818. Tax amount varies by county.

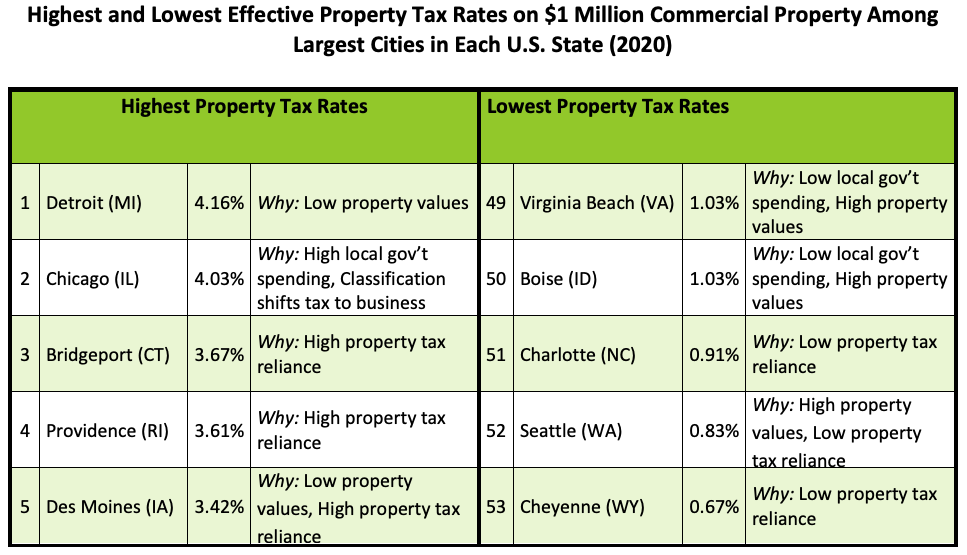

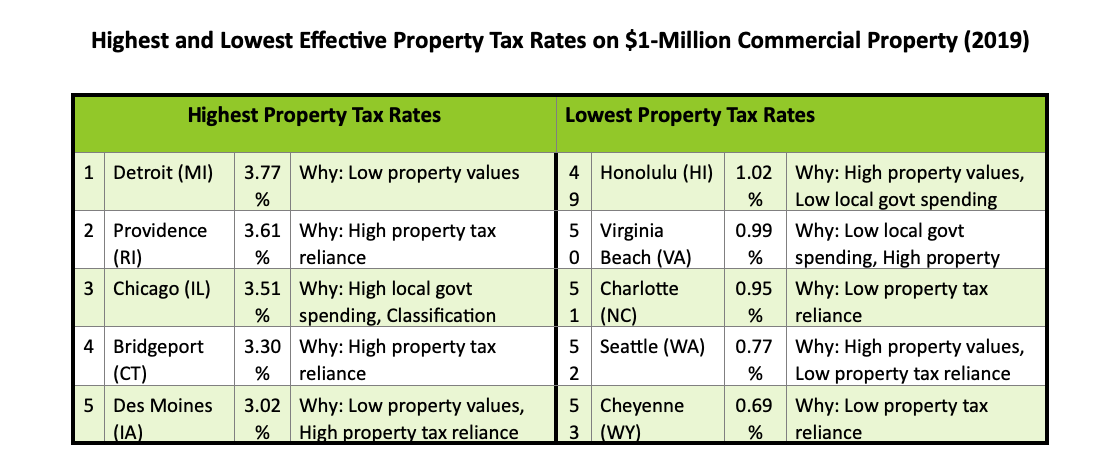

Taxes 2020 These Are The States With The Highest And Lowest Taxes

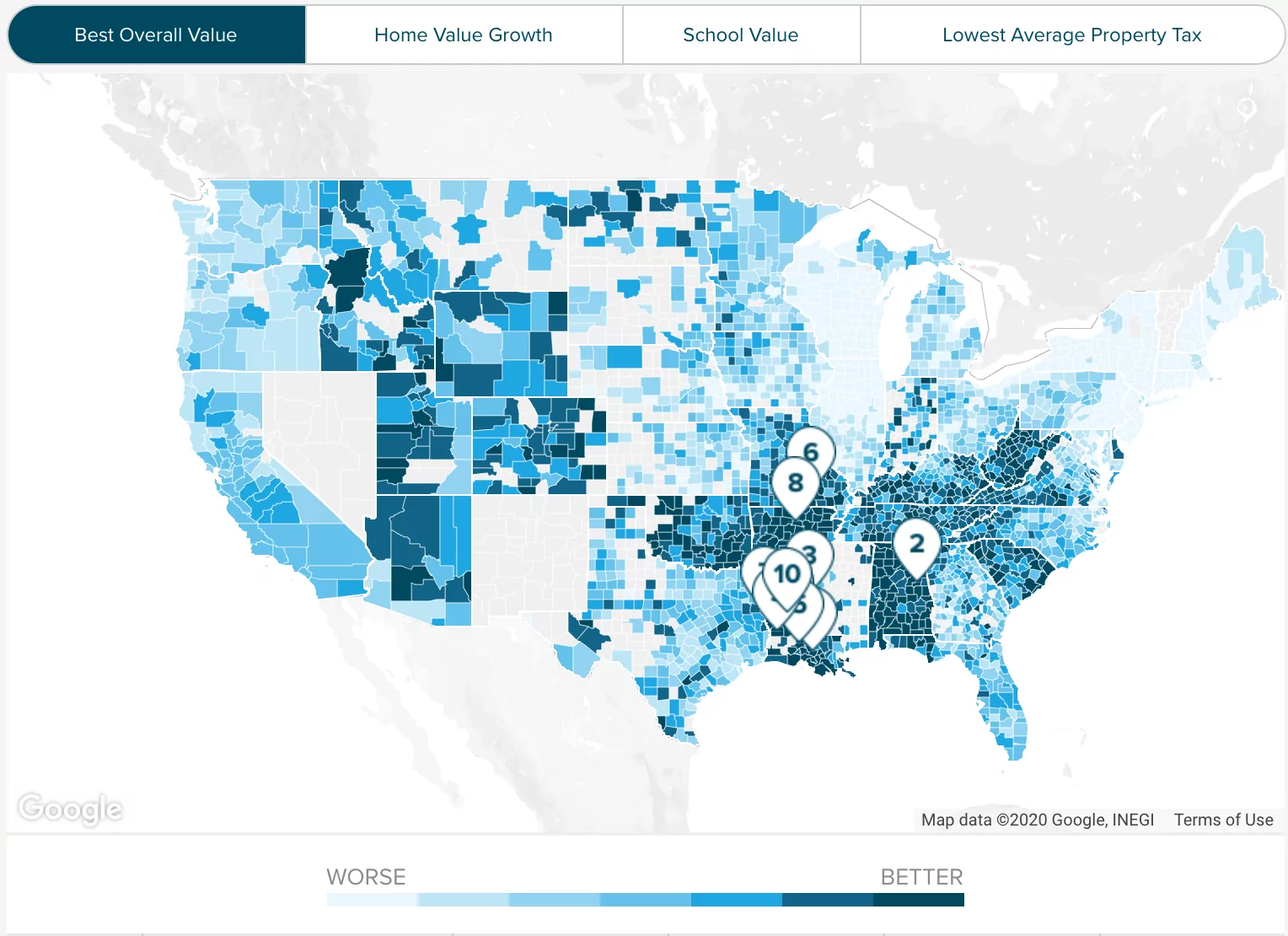

Property Taxes How Much Are They In Different States Across The Us

Funky Gourmet Restaurant To Move To Hilton Athens Hotel Gtp Headlines Athens Hotel Hotel Athens

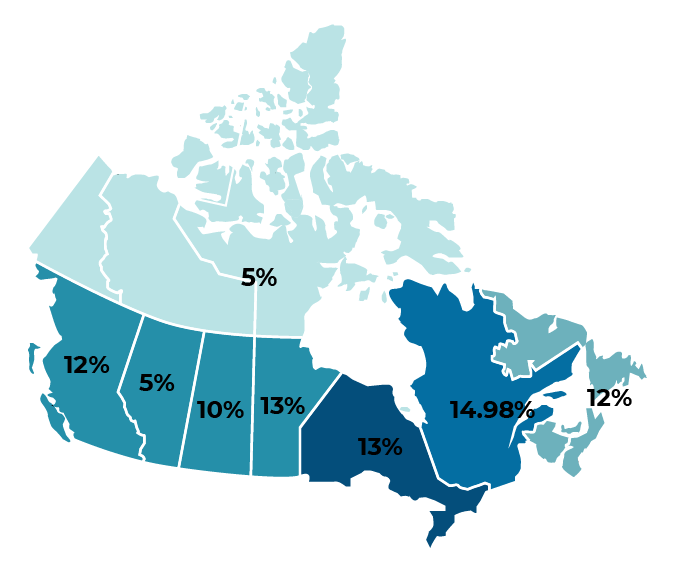

Which Province In Canada Has The Lowest Tax Rate Transferease

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

N338 94 Billion Was Generated As Vat In Q1 Nbs Nigeria National Nigerian

Delaware State Univeristy Calander University Calendar Academic Calendar Delaware State

Bhk Individual House For Sale In Kk Nagar Trichy Rei Bhalla Anime Modern Plans Spelle In 2020 Small House Elevation Design Architectural House Plans House Front Design

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Fifty State Study Shows Property Tax Inequities From Assessment Limits Continue To Grow

New York Property Tax Calculator 2020 Empire Center For Public Policy

2020 Polling Map Of The Csa On Rejoining The Union R Imaginarymaps In 2022 Fantasy Map Generator Alternate History Imaginary Maps

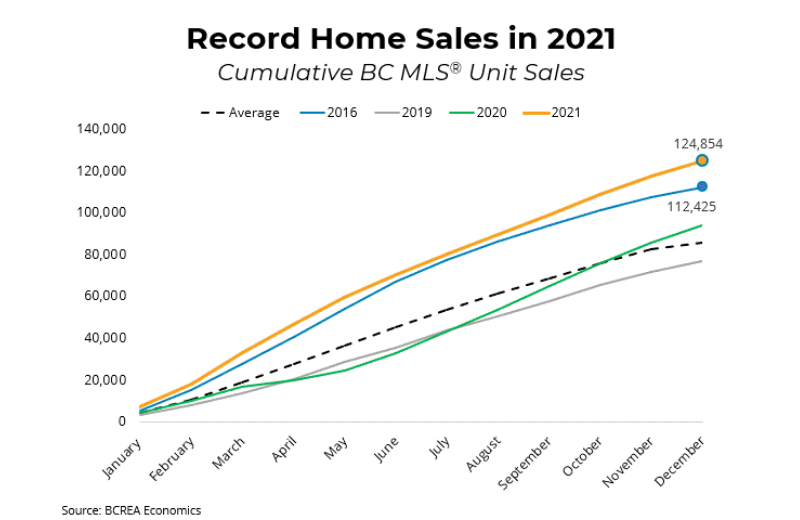

A Record Year For The Bc Housing Market British Columbia Real Estate Association

State Corporate Income Tax Rates And Brackets Tax Foundation